Customer interaction should always be proactive. For companies that are committed to putting their consumers at the heart of business, we believe that an interaction with a customer should be a part of a process, not an end in itself. And this becomes all the more vital in the gambling industry.

When we talk of customer interaction, we refer to how gambling firms identify people who may be experiencing, or at risk of developing, problems with their gambling, and how you interact with them to offer help or support. If you suspect a customer may be experiencing or at risk of developing problems with their gambling, you are legally required to interact with them to offer help.

Operators need to take the time to consider the impact that interactions have upon customers, and whether they meet individual consumer needs. What works for one customer may not necessarily work for another- especially where vulnerable players are concerned.

By harnessing the power of advanced, cutting edge tools, the easier it becomes for gambling firms to prioritise customer interaction, offer support to those who are at risk, and comply with the legal requirements and legislation expected of them.

Legal Requirements

The Gambling Commission sets out its LCCP requirements for customer interaction, which relays the minimum standards that gambling companies need to comply with. This includes identifying and interacting with customers who may be at risk of or experiencing harms associated with gambling, which is in line with the Social Responsibility Code.

Any breach of these conditions may lead to a review of the operator’s license, as well as possible suspension, revocation, or the imposition of a financial penalty. This also exposes the operator to the risk of prosecution.

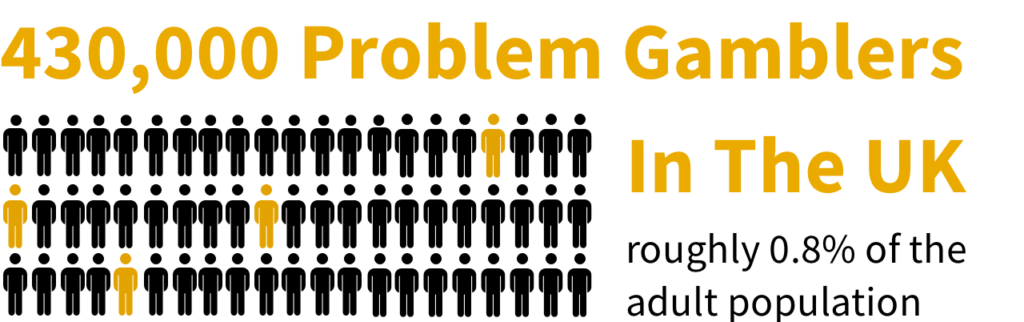

While the industry is generally progressing and improving in customer interaction, these requirements simply aren’t enough to ensure the protection of all players. As there are now 430,000 problem gamblers in the UK, it’s clear that much more needs to be done to protect consumers, including those who may be vulnerable.

So how can we ensure the safety of all players who choose to gamble online?

Safer Gambling

If the industry is to prioritise safer gambling, operators need to invest in customer interaction much more heavily.

In the fast-paced world of customer support and retention, warning signs of problem gambling can sometimes go unnoticed. This is precisely why operators need sophisticated, accurate tools to identify problem gamblers, which also protects your firm from the risk of fines and reputational damage.

Unfortunately, many operators believe that their in-house processes already offer sufficient customer protection. But greater accuracy is needed to detect problem gamblers who use multiple chats and agents, as well as those who have indicated early signs of self-exclusion.

This becomes ever more crucial when it comes to differentiating problem gamblers from those who are actively committing fraud. Signs of harmful gambling can often look similar to fraudulent activity, which means your diligence and monitoring procedures need to be as effective as possible.

Gambling operators therefore need to home in on consistent measures which enable them to help customers who are experiencing harm from their gambling, and protect them from further play. It’s about offering real-time, individualised support to a player who is at risk, and interacting with them before their gambling spirals out of control.

Best in class

While there are plenty of customer interaction tools around, our advanced customer risk analysis software is in a league of its own.

Meticulously built by industry experts, our easy-to-use platform is built with both agents and customers in mind. Rdentify integrates seamlessly with customer support systems (including your CRM), making it simple for your agents to use. Our platform comes with full customer analysis, building accurate risk profiles from live chat and historical player data in real time.

We use machine learning and linguistics research to identify behavioural and conversational patterns associated with vulnerable consumers, helping customer service agents spot risks quickly and effectively. Customer service managers can then audit team live chats and emails to ensure that they are properly interactive with high risk customers. Meanwhile, compliance teams can evaluate company responsible gaming performance to ensure regulatory requirements are met, and adhered to accordingly.

All of this helps you deliver successful customer interactions which, in turn, makes your gambling firm more efficient, mitigates risk, and protects vulnerable customers from harm. It’s not about replacing your current systems and in-house processes- it’s about enhancing them.

For operators who are committed to quality customer interactions- make sure you’re giving yourself the best tools for the job. Harnessing the power of NLP technology allows gambling companies to not only deliver positive outcomes for customers, but protect the reputation of the industry simultaneously.

Ready to enhance your in-house processes? Book your free demo here.