It’s safe to say that the gambling industry has changed dramatically over the years. Since the first online casinos launched back in 1994, there has been a digitally-driven consumer demand that has completely overhauled the industry at large.

While interfaces were fairly simple at this point, it wasn’t until 2005 that The Gambling Act was created. It’s therefore clear that technology, and the legislation needed to protect both operators and customers, has struggled to keep up with consumer demand for digital gambling.

As technology continues to evolve, one of the key challenges that operators will face is the management of increasingly complex technological ecosystems. This means that operators will need to invest in the right kind of technology to not only provide ease of use to the consumer, but also protect the correspondence of customers accordingly.

Enhancing in-house processes

When operators take a proactive approach to customer correspondence, the more likely they are to prevent at-risk customers from slipping through the net.

However, in the fast-paced world of customer support and retention, common signs of problem gambling can be missed. If gambling is sporadic and spread across multiple chats and agents, the more difficult it can become to liaise with players and protect them from harm. And this can lead to severe consequences for both the customer and operator alike.

Gambling firms therefore need to invest in specific, sophisticated software that can protect customer correspondence, which in turn helps identify consumers who are at risk from problem gambling.

This sounds simple in theory, but one of the key areas of pushback that we see from operators is their belief that their in-house processes are already fit for purpose. Some gambling firms feel that their systems adequately protect their customers, and adhere to the legislation and compliance set out by The Gambling Commission.

But the stats speak for themselves.

Unfortunately, there have been multiple instances of operators failing to identify and protect problem gamblers. And there have been serious consequences for firms who have not complied with the standards expected of them.

The Gambling Commission has now issued over £20 million in financial penalties, and this number is continuing to rise. These fines are for breaches where operators have failed to identify and act on harmful play.

Customers should feel safe during all aspects of game play, and there needs to be clear safeguarding processes in place to ensure risks are effectively minimised. News headlines about operator fines do damage to the industry at large, and chip away at individual reputations.

But it doesn’t have to be this way. Operators have the power to enhance their customer correspondence to signpost at-risk players to the help and the support they need, while protecting business assets at large.

This is where we can help.

Using Rdentify

While there are many companies out there promoting technological tools for gambling operators, Rdentify breaks away from the pack.

After asserting ourselves in the gambling industry, we’ve been able to use our decades of knowledge and experience to craft a tool that allows operators to conduct game play with ease, while protecting customers and business assets simultaneously.

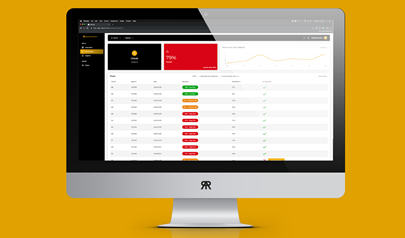

We use detailed machine learning and linguistics research to identify behavioural and conversational patterns associated with vulnerable consumers, helping customer service agents spot risks quickly and effectively. Agents can then produce actionable customer problem gambling risk flags based on all previous correspondence, while customer service managers can audit team live chats and emails to ensure that they are properly interactive with high-risk players.

It’s important to note that Rdentify doesn’t change your current in-house processes- it simply works to enhance them. Our customer risk analysis software blends seamlessly with your systems, and offers direct integration with your live chat and CRM tools. By utilising our NLP technology, you’ll be able to conduct a full customer analysis, build accurate risk profiles from live chats, and access historical player data in real time.

For operators that are serious about minimising customer risks, Rdentify works as the perfect partner. Our platform allows you to visualise your risk data, and perform in-depth trend analysis of your entire customer base on the Rdentify User Interface. As no personal data is ever stored on our servers, your teams will be able to be proactive and take full control.

It’s now more easy than ever to enhance in-house systems, and deliver positive outcomes for customers and business alike. That’s why we’re on hand to simplify day to day processes, and uphold your reputation as an in-demand gambling firm.

Ready to enhance your in-house processes and protect your correspondence? Why not book a free demo with our team today.