As commerce continues to shift online, it’s clear that digitalisation is absolutely essential for modern customer service. It is key to connecting customers with knowledgeable agents, delivering the context needed to solve problems quickly, and providing consumers with more engagement options than ever before.

When businesses put technology-focused customer service at the heart of their operations, they have a real opportunity to gain a competitive advantage. Digital tools can provide a seamless experience between channels, and enrich customer interactions with agents and representatives. This means that your business will be able to drive better outcomes at a reduced cost.

It’s also important to remember that technology shouldn’t replace personal, real-life engagement with customers. Digital tools should work in harmony with a humanistic approach to customer service, which can enhance consumer experiences to provide them with positive resolutions and direct results.

This harmony between technology and real-life engagement becomes even more essential when it comes to vulnerable customers. Businesses need to be doing everything they can to identify and protect those at risk- especially in today’s climate.

Vulnerable Consumers

During the course of the pandemic so far, the number of consumers that have found themselves in vulnerable circumstances has soared. And this number is set to increase due to huge tax hikes, higher energy bills, and the rising cost of living.

According to the latest Financial Lives research conducted by the Financial Conduct Authority, 27.7 million adults in the UK now have characteristics of vulnerability such as poor health, experiences of negative life events, low financial resilience, or low capability. Not everyone with these characteristics will suffer harm, but they may limit people’s ability to make reasonable decisions and put them at greater risk.

Businesses should therefore be taking the time to source customer-focused tools and technology to help their most vulnerable customers. By investing in sophisticated digital platforms, companies can not only deliver effective, personalised service to individual customers, but also monitor and protect those who may be susceptible to harm.

Our platform

At Rdentify, customer wellbeing is something that we take seriously, and we’re doing everything we can to make it easier for businesses to identify and safeguard those who may be at risk.

After working in the gambling industry for a number of years, our experts decided they wanted to offer businesses an accurate, reliable means to protect their vulnerable customers. Instead of using technology as a means to replace in-house processes, we’re using relevant, cutting-edge software techniques to help companies enhance their current customer service methods to deliver quality outcomes.

With a specialisation in high-risk regulated sectors, Rdentify mitigates customer risks in industries including gaming, finance, legal, and energy. Our platform brings together state-of-the-art machine learning and linguistics technology to provide smart customer protection that is measurable and auditable. This allows your business to improve internal processes, and demonstrates your commitment to customer wellbeing to regulators and consumers alike.

We provide vulnerability risk scores to front-line staff so they can safeguard customers, while protecting your business from threats such as regulatory risk. By proactively communicating with vulnerable customers, your organisation not only boosts its reputation as a business, but also reduces the possibility of penalties and fines.

How it works

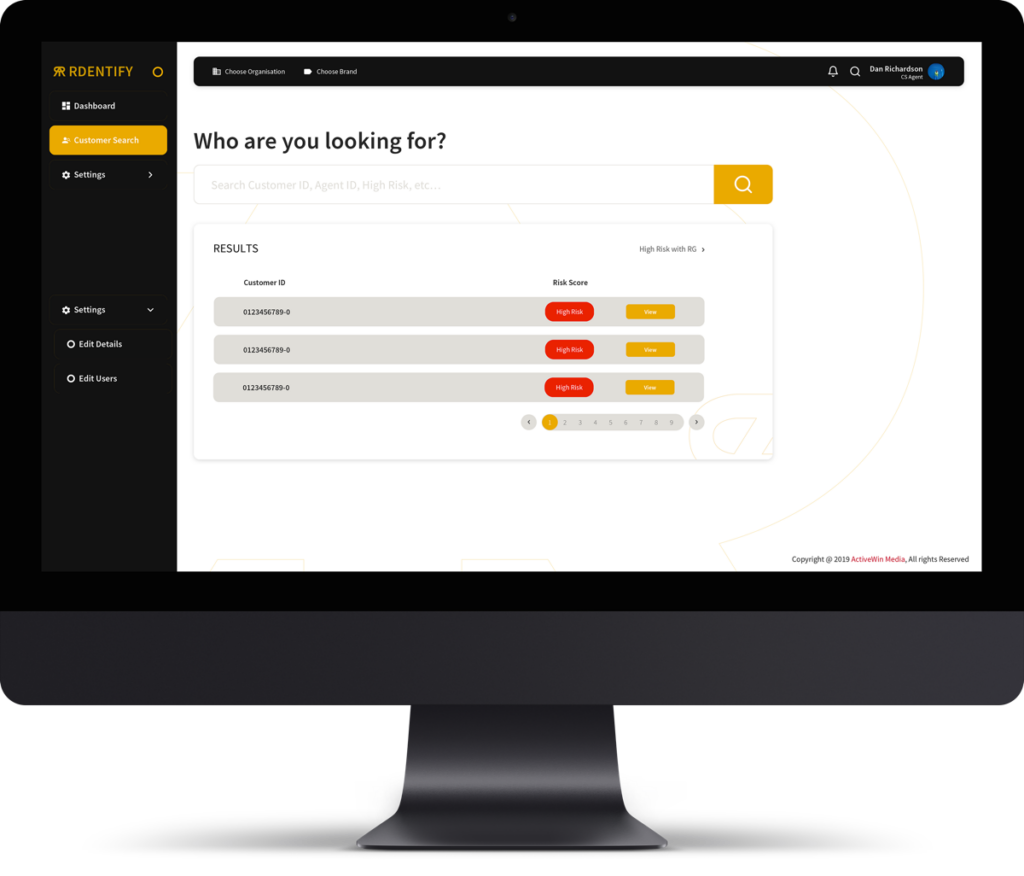

Rdentify integrates seamlessly with your systems, including your CRM. This makes our platform straightforward for your agents to use. Utilising advanced technologies, we have made sure our product is easy to adopt and use as part of your day-to-day customer support routine.

Our intuitive user interface allows in-depth trend analysis, and builds accurate risk profiles from live chat and historical player data. This drives improved decision-making in real time. Rdentify allows customer support agents to make quick, evidence-based decisions to protect both the end-user and your business, and deliver appropriate resolutions for vulnerable consumers. It’s about enhancing in-house processes to protect all parties, and prioritising customer wellbeing in unprecedented times.

And when it comes to calculating individual categories of risk scores, we believe simplicity is key. Through an easy-to-understand 1 to 5 scoring system, we alert problem gambling risks to front-line staff, who can then provide personalised assistance and signposting for vulnerable customers.

When you partner with us, we want you to be assured that our new risk identification factors are continuously enhanced. This allows you to be confident that the features within Rdentify are always up-to-date, and hassle-free for your business to use.

By harnessing the power of digital tools, we can work together to protect vulnerable consumers and businesses alike. At a time when customers are facing increasing hardship, companies have the power to make life easier for consumers, and provide authentic, meaningful experiences that exceed their expectations.

Interested in hearing more about how our technology can help your business? Get in touch with our team or book a free demo today.