Empower Secure Customer Engagement and Data Protection

In the fast-paced world of financial services, building secure customer relationships while safeguarding sensitive data is non-negotiable. Social engineering threats loom large, seeking to exploit vulnerabilities and compromise the trust that underpins financial transactions. Rdentify offers tailored solutions that fortify customer engagement, enhance compliance, and secure critical interactions.

Addressing Financial Services Challenges

Heightened Responsibility

Financial institutions hold significant responsibility for protecting customer data and ensuring secure transactions.

Rising Threats

Social engineering attacks are on the rise, exploiting human interaction to breach financial systems and compromise sensitive information.

Regulatory Compliance

The financial sector operates within stringent regulatory frameworks that necessitate data protection, transparency, and compliance.

Efficiency

At a time of rising costs and heightened customer expectations, enhanced efficiency is paramount.

Empowerment Through Rdentify Solutions

Rdentify Secure

Challenge

Protecting customer data and financial transaction integrity in a rapidly evolving landscape.

Solution

Rdentify Secure offers a tailored solution against social engineering attacks within financial communications by monitoring conversations for phishing, lobbying or subversion attempts.

Proactive Defence

Rdentify empowers financial institutions with a proactive defence mechanism against evolving social engineering threats.

Risk Reduction

Significantly reduce the risk of financial losses, data breaches, and regulatory non-compliance through Rdentify’s robust protection.

Enhancing Customer Trust

Safeguard customer trust by ensuring the confidentiality of financial conversations and transactions.

Full Audit and Reporting

Rdentify’s comprehensive audit trail and reporting feature provide transparency and accountability.

Rdentify Protect

Challenge

Balancing customer engagement and data security in financial interactions.

Solution

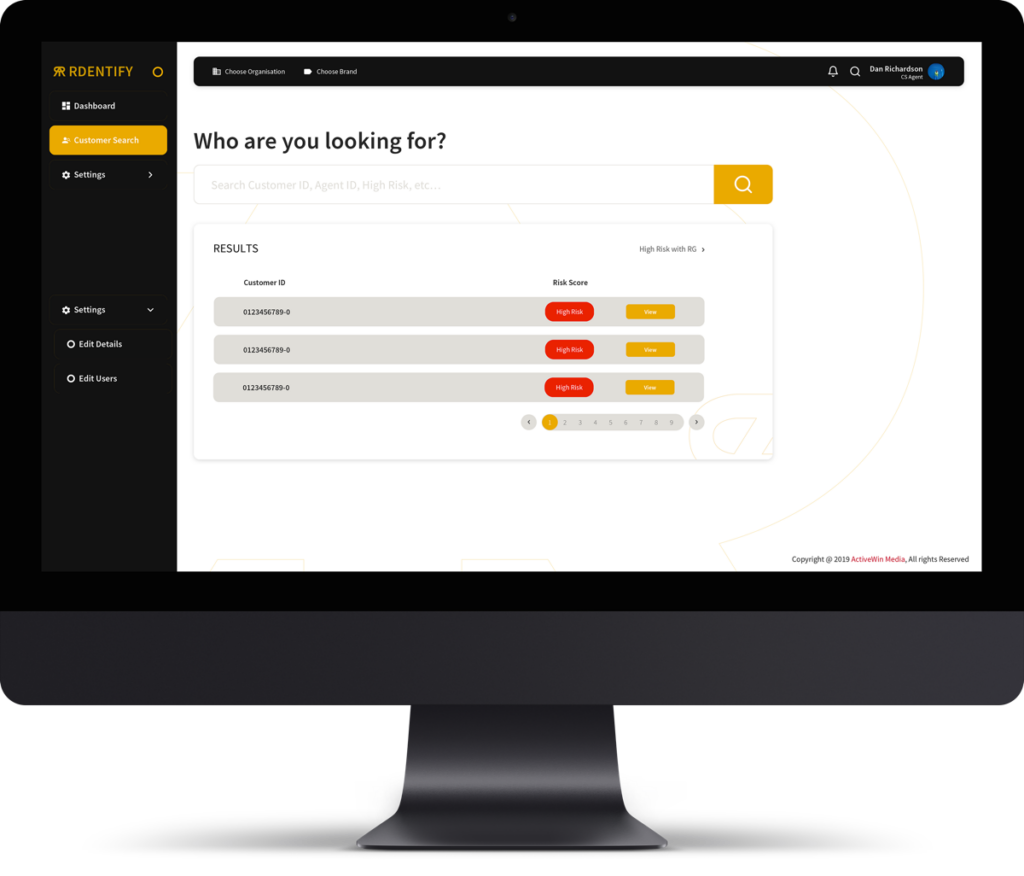

Rdentify Protect offers real-time analysis to enhance customer support interactions and detect customer vulnerability.

Secure Customer Interaction

Provide secure and genuine engagement with customers, guiding them through financial decisions.

Vulnerability Identification

Swiftly identify and address vulnerable customers, ensuring their financial well-being and protection.

Customisable Vulnerability Scores

Equip customer support teams with the tools to make informed decisions based on vulnerability assessments.

Evidence-Based Decision-Making

Ensure that financial decisions are backed by data-driven insights, enhancing customer support outcomes.

In the fastpaced realm of financial services, establishing robust customer relationships while safeguarding sensitive information is paramount. Rdentify presents tailored solutions that redefine customer engagement, enhance compliance, and elevate financial well-being.

Rdentify TeleMate

Financial institutions thrive on customer support excellence, where communication accuracy and compliance are non-negotiable. Rdentify TeleMate provides comprehensive conversation analysis to transform customer support excellence.

Transcription and Summarisation

Automatically transcribe and summarise customer conversations, allowing for streamlined review processes and quick understanding of customer concerns.

Tagging for Query Analysis

Tag conversation types for in-depth query analysis, enabling teams to extract valuable insights for improving support strategies.

Automated QA

Set up automated Quality Assurance checks to ensure that crucial questions are consistently asked, enhancing compliance and customer satisfaction

Flagging High-Risk Conversations

Instantly flag high-risk conversations for immediate review, empowering teams to address sensitive issues promptly.

SafeBots

At critical touchpoints in the financial journey, customer engagement and data protection intersect. SafeBots, our innovative technology, ensures secure and personalised interactions, enhancing financial well-being and regulatory compliance.

Financial Wellbeing Assessment

Safely interact with customers to assess their financial well-being, offering tailored guidance and support based on individual circumstances.

EDD Requests with Explanations

Request Enhanced Due Diligence (EDD) documents with friendly explanations, ensuring transparency and compliance in a customer-centric manner when the customer is engaged.

Automated Support

Leverage automated interactions to guide customers through essential processes, making financial tasks seamless and hassle-free.

Regulatory Adherence

Maintain regulatory adherence while engaging customers in important interactions, fostering trust and compliance simultaneously.

Research for Continuous Enhancement

Conversation Type Recognition

Objective: Enhance the ability to accurately recognise and categorise different conversation types.

Research Focus: Developing advanced models for recognizing complex financial queries and discussions.

Impact on Product: Improved categorisation for targeted query analysis and more effective decision-making.

Behavioural Insights

Objective: Deepen understanding of customer behaviour and preferences in financial interactions.

Research Focus: Analysing behavioural cues to provide personalized insights for financial well-being.

Impact on Product: Enhanced personalisation and customization of SafeBots’ interactions for improved customer outcomes.

Rdentify is your partner in shaping secure and efficient customer interactions within the dynamic landscape of financial services. Our solutions provide the technological prowess necessary to safeguard sensitive data, enhance customer trust, and navigate regulatory frameworks seamlessly.